When I was asked to write about my own insurance portfolio, I felt both excited and a little apprehensive.

I have been in the industry for more than 15 years and have always taken pride in helping clients protect themselves with the right solutions. I strongly believe that insurance should support your financial life, not complicate it. That is why Havend’s philosophy of “Get As Much As You Need, Pay As Little As You Can” resonated deeply with me when I joined in 2024.

Yet, if I am honest, while I have been busy reviewing my clients’ portfolios, I have not always been as attentive to my own. They say doctors make the worst patients, and in many ways, that applies to me too.

This article is my sincere attempt to share where I am well protected, where I am lacking, and why Havend is a safe place to have honest conversations about insurance.

A Little About Me

I lead a team of Insurance Specialists at Havend, and although my time here is still relatively short, I bring with me more than 15 years of experience across banks and insurers.

On a personal note, I am married and have a six-year-old daughter. They are the reason I do what I do every day, and they have shaped how I think about protection more than anything else.

Why the Pillars of Protection Matter

When I joined Havend two years ago, I was introduced to the concept of the five pillars of protection. This concept is not new, however, to break down the core protection needs into the five pillars was something that I felt was very easily understood.

I often tell my clients that in a catastrophic event, they would already be suffering emotionally. We should not allow them to suffer financially as well. The goal is to ensure that the family’s income and stability are not broken by illness, disability or death.

Not everyone can cover every pillar fully at every stage of life. What matters is knowing where your shortfalls are and deciding what to address first.

Pillar 1: Income Protection in the Event Of Death

The first pillar, is now a non-negotiable for me. With a spouse and a young child depending on my income, this pillar ensures that my family can maintain stability if I’m no longer around. My coverage is sized for today’s responsibilities — mortgage, daily living, and my daughter’s education — and I fully expect this pillar to evolve as those responsibilities grow.

I also consider myself fortunate in this area, as it I am not spending too much in this. I am a strong believer in the philosophy of “Buy Term, Invest the Rest,” as term insurance typically provides the highest level of coverage at the most cost-effective premiums.

Looking back, I was fortunate to have secured my first term plan at the age of 27. At the time, an agent friend of mine needed to meet his KPI and approached me. Back then, while I was working in a bank as a Relationship Manager, insurance was not something that particularly resonated with me. Nonetheless, I decided to support him by taking up a simple and affordable term plan that provided $1,000,000 in coverage up to the age of 65, at a monthly premium of about $50.

Although I did not fully appreciate the value of the plan at that point, I am grateful that my friend encouraged me to proceed. If I were to purchase the same coverage today, the cost would likely be three to four times higher as premiums are locked in according to the age that the client applies for the plan.

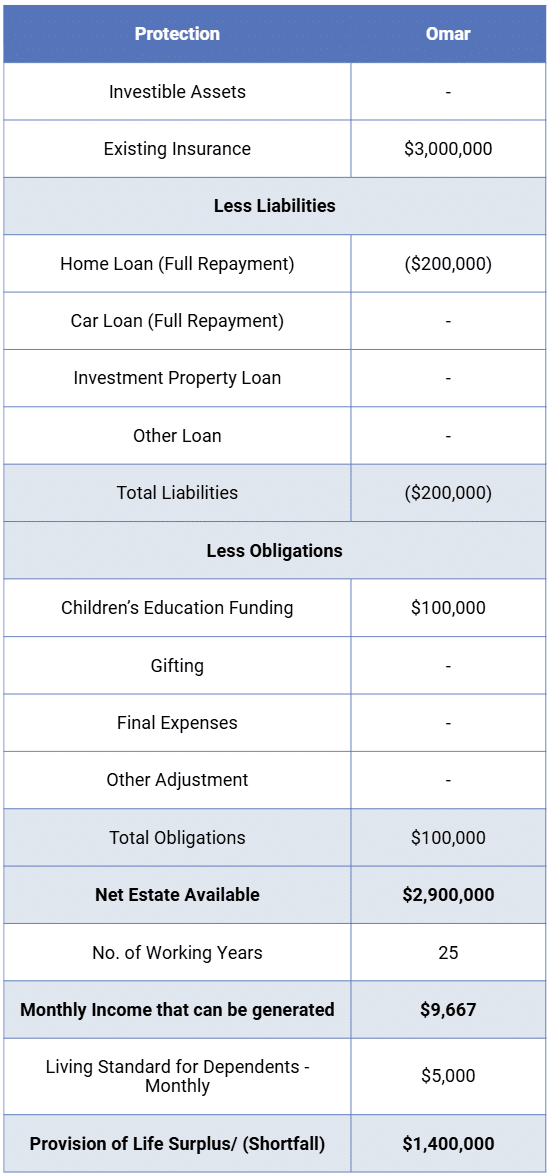

When my daughter was born, I revisited my protection planning and decided to take up an additional term plan that would provide another $1,000,000 payout in the event of my death, ensuring my family would be adequately protected. Combined with my initial term policy and a MINDEF Group Term Life plan that offers a further $1,000,000 in coverage, I believe I am reasonably well-covered under this pillar based on my own calculations.

The section below outlines a rough breakdown of how this coverage was determined, before factoring in my assets and assuming a retirement age of 65.

Pillar 2: Income Protection in the Event of Critical Illness

When it comes to Critical Illness planning, many people assume these policies are meant to pay for medical treatment. In reality, most treatment costs are already covered by hospital insurance. This often leads to the question: why is a Critical Illness plan still necessary?

For me, the real purpose of a Critical Illness plan is income protection. It is meant to give me the financial breathing space to step away from work and focus on recovery, without breaking the household income chain. During this time, my family’s lifestyle, day-to-day expenses and long-term plans do not need to be put on hold simply because I need time to heal.

So how much coverage is enough? A commonly used guideline is to insure between two to five years’ worth of income. This provides a reasonable buffer for recovery, rehabilitation or even a possible career transition if needed.

In my own case, this is an area where I know I could be stronger. My current Critical Illness coverage provides about two years of income if I am diagnosed. This meets the minimum guideline, but could certainly be improved.

As my income grows over the coming years, there will be a need to increase this coverage, especially since I am the primary breadwinner for my family. However, at this stage of life, most of my financial resources are focused on meeting my family’s immediate needs. Increasing my Critical Illness coverage right now would be challenging.

This is something I fully intend to revisit in the near future, so that my protection better reflects both my responsibilities and my evolving financial circumstances.

Pillar 3: Income Protection in the Event Of Disability

This is the pillar where I realised I am lacking in.

Despite being in the industry for many years, I currently have no plan that pays out if I become disabled and can no longer work. This often surprises people, but the truth is that I placed this aspect of planning aside for a long time, believing that “it wouldn’t happen to me.”

Your ability to earn an income is one of your most valuable assets, especially in your working years. A Disability Income policy is meant to protect that income if illness or injury affects your ability to work.

For example, if a surgeon earns $15,000 a month but can only take on a teaching role that pays $10,000 after an accident or illness, a Disability Income policy can help bridge that $5,000 gap. This prevents sudden and drastic changes to lifestyle or financial stability.

In recent years, I have seen friends and acquaintances suffer strokes or heart attacks that left them partially disabled, even though they appeared healthy. These experiences made me reflect more deeply.

I began asking myself a simple but difficult question: what if it were me? How would my family cope if I could no longer be the main breadwinner?

This is an area I intend to address this year. Not out of fear, but out of responsibility, so that my family will not have to bear the financial consequences if my income-earning ability is ever compromised.

Pillars 4 and 5: Medical and Long-Term Care

Medical and long-term care protection are pillars that stay with you for life. Catastrophic health events can happen at any age, which is why these needs are considered part of the “Medical Safety Net” in retirement planning.

For my own portfolio, I have medical coverage through an Integrated Shield Plan that provides private hospital care. For long-term care, I have a CareShield Life Supplement that pays out $3,000 if I am unable to perform three out of six Activities of Daily Living. These plans give me confidence that I am covered for major health risks without placing my family under financial strain.

Interestingly, the same friend who sold me my first term plan years ago also encouraged me to take up my Integrated Shield Plan. Looking back, that advice laid the foundation for what I now see as a healthy and balanced insurance portfolio.

How Becoming a Father Changed My Priorities

The biggest shift in my insurance planning came when my daughter was born in 2020.

I first ensured her hospital coverage was in place. Then I arranged protection for her life and critical illness needs, followed by an education plan so that funds would be available whether she chooses to go to university or not.

Writing this article made me realise that I had strengthened her protection while leaving gaps in my own. Yet, if I could turn back time, I would probably make the same choices again.

As parents, we often want the best for our children, sometimes even at the expense of our own needs. Peace of mind comes not only from knowing we are protected, but also from knowing our loved ones are.

A Work in Progress

Even after more than 15 years of advising clients, I still see shortfalls in my own portfolio. And that is okay.

Protection planning evolves as life changes from being single, to becoming a spouse, to becoming a parent. What matters is recognising the gaps and taking steps to improve over time.

At Havend, we believe insurance conversations should be honest, safe and pressure-free. This is a space where you can look at your own situation clearly, without judgment and without being pressure-sold to.

If sharing my own story helps someone reflect on their protection needs, then this article has done what it set out to do.

This is an original article written by Syed Omar, Lead, Insurance Specialist at Havend.