In my previous article dated 28 November 2020, I wrote about universal life policies (ULPs) being touted as good instruments that allow the affluent to free up more cash for their retirement while still leaving a significant legacy. But ULPs are not the holy grail to legacy planning as there may be a more cost-effective alternative found in a simple term plan. ULPs are expensive due mainly to 3 big costs – (1) Premium charge, estimated to be between 7-9% of initial premium (2) Policy fee which consists of a monthly deduction, the mortality charge, as well as huge surrender charges especially in the first year and (3) commissions which can be as high as the premium charge. As a result of these costs, upon inception of a ULP, the cash value will typically start at about 70% to 80% of the initial single premium. You have effectively lost 20% to 30% of your money immediately on day one. So, is the humble term plan a better option?

Peter, a 45-year-old high income earner would like to buy a traditional ULP with a sum assured of US$5 m. The premium amounts to US$1.33 m. He takes a premium loan of US$900,000 and pays US$430,000 cash up front. Based on an average 2.5% p.a. interest across the loan period, Peter needs to pay interest of US$22,500 p.a. Alternatively, Peter can opt for term insurance with the same sum assured that covers him up to age 100. He pays a premium of US$38,537 p.a. instead.

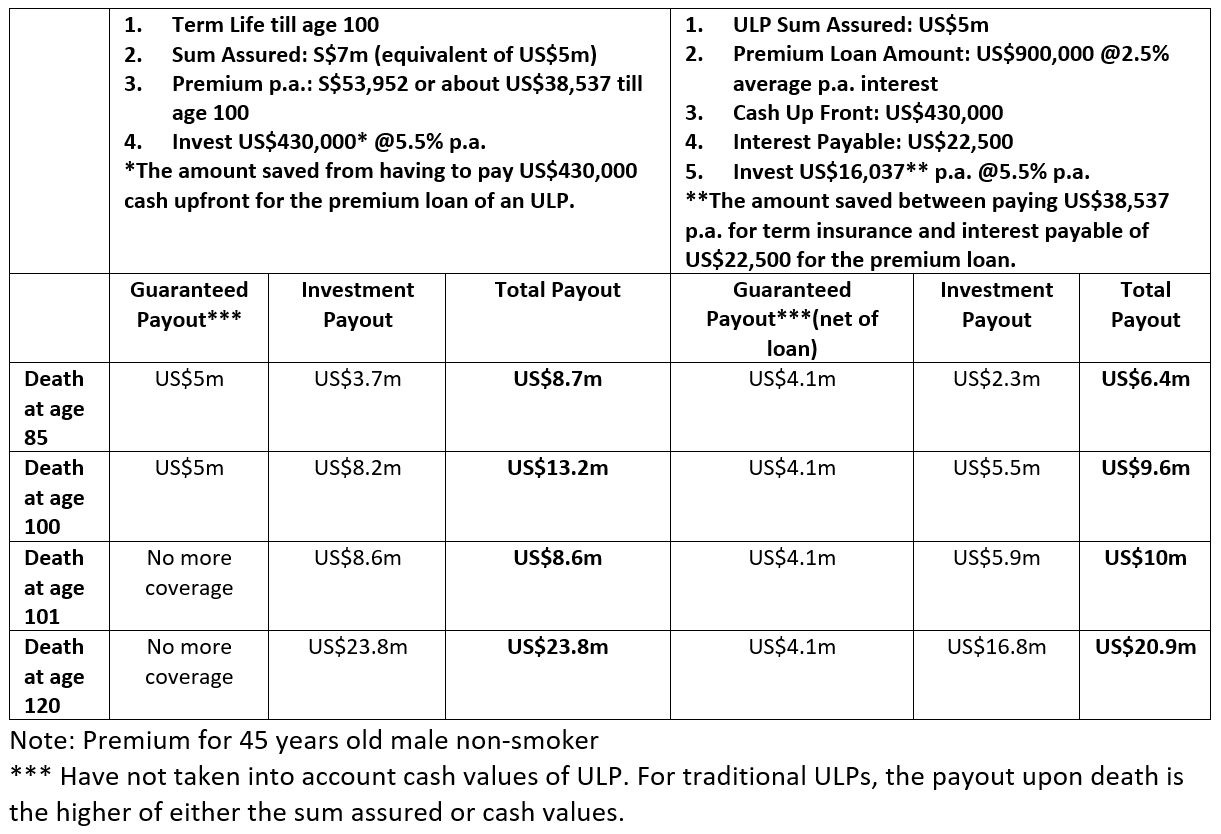

Looking at the scenario holistically, If Peter had bought the term plan, he would have avoided paying US$430,000 cash up front and can invest it instead. If he had chosen to go for the ULP, he would not have the US$430,000 to invest but because he pays US$16,037 p.a. lesser as compared to the premium of the term plan, he can invest this amount. The table below shows the outcome of his choices.

There are a few observations we can make:

- If death occurs anytime between age 85 to age 100, the total payout from the term option is better

- When term insurance ceases at age 101, the ULP total payout exceeds the term option

- Assuming death occurs at age 120, the term option beats the ULP solution again. But, the question is, what is the probability of living beyond 100 years old? A difficult question to answer, I know.

Also, we did not include the growth of cash values of the ULP, which If it grows higher than the sum assured, that will be the payout instead and the ULP option may be better. So I did a simple calculation based on 70% of the initial single premium invested upon inception of the ULP and found out that for the ULP total payout to be at least equivalent to the term option:

- At age 85, the ULP’s cash value needs to be at US$7.3m and thus, the ULP’s ROI needs to be 5.28% p.a.

- At age 100, the ULP’s cash values need to be at US$8.6m, and thus, the ULP’s ROI needs to be 4.13% p.a.

- At age 120, the ULP’s cash values need to be at US$7.9m, and thus, the ULP’s ROI needs to be 2.73% p.a.

For traditional ULPs, it might be difficult to achieve this kind of ROI at age 85 but the ROI seems realistic for age 100 and 120. But if you buy ULPs which have a lower front load cost or use a wealth adviser like us that rebates you the commission, the ROI needed can be lower. Note that we have not considered the premium loan interest rate which can be different from what we assumed and also currency risk of the USD. In the case of the term option, there are less moving parts. There is no currency and interest rate risks as term plans are denominated in SGD and you do not need premium financing. Also, with the term option, you have the option to terminate the plan early whereas with ULPs, high surrender charges may mean losing a substantial amount of your premiums paid. You can also customise the investment portfolio of the term option according to your risk appetite which you cannot do the same in traditional ULPs.

So there is no clear conclusion to whether ULPs or term insurance is better. But I hope this discussion has shown you that there are much to consider and ULPs are not the only way. One thing that is certain is that legacy planning is not about buying ULPs. Legacy planning is about developing a strategy to define, reflect on, and express what wealth really means to a family so that not only financial wealth, but also the family’s core values are passed on to future generations. For business owners, financial wealth could even include passing on the business and therefore business exit and succession planning are important. ULPs are just one of the many instruments a wealth adviser can use to create and transfer financial wealth to his loved ones. So, before you buy your next ULP, first have a deep conversation with your trusted adviser.

The edited version of this article has been published in the Money Wisdom Column of The Business Times Weekend on 23rd January 2021.

For more related resources, check out:

1. A Comprehensive Look at Legacy Planning and Gifting with Universal Life Policies – Part 1

2. Why Do We Prefer Term Insurance Over Whole Life Plans?