Every child is a gift! As parents, we naturally strive to provide them with the best, even if it comes at a cost. Life insurance is one such consideration…but only if it makes sense.

So, should we get life insurance for our children? Otherwise, which insurance should we buy for our children?

If you have been searching online, lo and behold, there are already many articles written on it, mostly on what you should do.

As a parent to three school-going children myself, perhaps I can draw from personal experience to illustrate the thought process and framework for choosing life insurance for children.

First Things First: Hospitalisation Insurance

One of the worries that keeps parents awake at night is when our child falls ill. We go through this dreaded routine of self-medication, prayer, seeking advice from well-meaning experienced parents, and visiting the 24-hour Accident & Emergency children’s clinic, hoping the child will find needed relief and recover.

But what if the condition is more serious, requiring hospitalisation? More stress ensues, with financial costs not far from our minds.

Thankfully, we have a very good healthcare support system that ensures every Singaporean and Permanent Resident is covered by MediShield Life, designed to sufficiently take care of big bills pegged to B2/C wards in public hospitals.

Should you upgrade to higher wards?

It depends on your expectations for healthcare and your financial abilities.

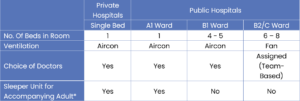

The table below highlights some key differences for the various hospital wards. If you prefer the option to choose your doctors or even sleep by your child’s side, then you will need to upgrade to an Integrated Shield Plan (IP) that corresponds to your desired ward types.

*See footnote below.

In my case, I choose an IP that allows me to go for up to private hospitals.

My Key Reasons

- I want the option to choose my preferred doctors and hospitals, even private ones, if necessary, without being restricted by these considerations.

- I prioritise easier access to doctors, who are usually in private hospitals, resulting in shorter waiting times.

- The premium for IP (even for private hospitals) is quite affordable when they are still young. In fact, their premium can be fully paid by CPF money, although the optional rider (to reduce out-of-pocket payment for hospital bills) requires cash payment. When they are older, I could always downgrade to save costs, if necessary.

- I worry that if they were to suffer any medical condition in the future, it would affect their eligibility to upgrade.

- Other benefits, like pre- and post-hospitalisation benefits (which I won’t elaborate on in this short article), also influenced my decision.

In fact, I applied for the IP within the first month of my children’s birth, without procrastination, just in case any unexpected medical condition prevented getting one.

How I Have Benefited

Through their growing up years, two of my kids unfortunately required hospital treatments. My eldest child underwent an operation to remove tonsils and adenoids, which was frequently inflamed and caused difficulty in her breathing through her nose. My second child was hospitalised three times before the age of three due to a urinary tract infection. Thankfully, they are well now.

Interestingly, we chose KK Hospital even though we could opt for private hospitals, purely because it specialises in treating children. The estimated bills for both hospital stays came to about $20,000 and were mostly covered by the IP.

Parents’ Consideration

Getting an adequate hospitalisation plan is the first priority for a child’s insurance. Whether is it the standard MediShield Life or an IP, do consider these factors:

- Your expectations on the ward types for your child.

- Affordability – always work within your means.

- Get it as early as possible.

Personal Accident Plan

Kids are prone to injury – that is why mothers are always very protective. My wife was no exception.

My eldest child hurt her elbow one day while playing and had to be treated in the KK Hospital Accident & Emergency (A&E) outpatient clinic. The estimated cost was about $100.

My second child suffered a deep cut on the head when he fell onto a glass table after losing his balance. He required seven stitches at Mt Alvenia Hospital A&E. The estimated bill was about $800. These bills are not covered by MediShield Life or IP as they are outpatient treatments.

I did not get a Personal Accident (PA) plan for my children in these two incidents. And that is because I often view a PA plan as optional.

My Key Reasons

- I am fine with self-insuring for outpatient treatments as these are usually not big-ticket items. In any case, most PA plans do not offer high coverage for outpatient treatment, usually just a few thousand dollars in benefits.

- If the accident is a serious one, it would likely require hospitalisation, in which case it would be claimable under MediShield Life or an IP.

- If a death benefit is important, I would rather get a life insurance policy that offers an “all-cause” death benefit rather than relying on a more restrictive accidental death benefit.

To be precise, I did get a PA plan for my children on an on-and-off basis because my conviction was not strong, since I can always self-insure. Annoyingly, whenever I stop my PA plan, small accidents do happen, but I am fine with it because the exposure is not significant to me.

Parents’ Consideration

It is perfectly fine to get a PA plan to transfer the risk to the insurance company, or if you prefer, to self-insure. What is more important is to have an adequate hospital plan that takes care of the big-ticket medical bills.

If you are thinking of getting one, it may be more economical to opt for a family plan that covers the entire household instead of individual plans.

Critical Illness Insurance

Life insurance is meant to replace loss of income in events such as death and critical illness. Since children do not earn income, to begin with, there is no income loss to protect.

For children, there are two key rationales to consider for life insurance.

- To provide the loss of parent’s income, who might want to stop working to care for the child in the event of a critical illness. In a dual-income family, one spouse may choose to become the caregiver, using the payout from the critical illness policy to replace their lost income.

- To secure insurability for critical illness policies in the event of any future medical risks that might preclude the child from getting insurance.

For my children, I have gotten them a critical illness Term policy that covers them till age 99.

My Key Reasons

- I want to ensure my children have a basic critical illness policy regardless of how their health might turn out in the future.

- Beyond the typical 37 late-stage critical illness definitions, I would like the policy to also include relapse of critical illness benefit and early-stage critical illness definitions.

- I want to get a basic policy that is not too expensive, hence a Term policy suffices. For reference, such a multi-pay critical illness term policy costs less than $1,000 a year for a newborn, offering a $300,000 payout for late-stage critical illness, 2 times relapse benefits totalling another $300,000, with early-stage payout and others.

Some people advocate getting a whole life policy that requires only 20 years of premium. That is fine too, but I would still prefer the above Term to age 99 because I can reduce my annual cost of insurance to the minimum and get the multi-pay critical illness feature that is mainly found in such term policy and not whole life.

Parents’ Consideration

- Unlike hospitalisation insurance, life insurance is not a must-have for children, hence you should consider it only if it is within your means.

- Ensure you have put in place an adequate hospitalisation plan first.

- Prioritise adequate protection for the parents first before committing to such insurance for the children. Like Aesop’s fable, it is more important to protect the goose that lays the golden eggs (parents) than the egg itself (the child).

Getting the right insurance for children need not be complicated. Focus first on the important protection, especially hospitalisation needs and the protection for the parents. Consider additional coverage like Personal Accident and Critical Illness when you have additional funds.

Footnote: *Some public hospitals, such as KKH, offer sleeper units for accompanying parents. However, these may come with certain restrictions for B1 Ward and below. For example, parents at KKH can only use their foldable beds from 7pm to 7am. This can be challenging for parents who cannot rest if their children are unsettled during the night.

Do reach out to us for a complimentary InsureWell Assessment to find out if you are adequately covered with your existing insurance, so you can start considering insurance for your children. We promise to tell you if you have enough insurance and if that is the case, you need not purchase any insurance from us.

This is an original article written by Eddy Cheong, CEO of Havend.

At Havend, if we are found to have oversold you, we have put in place a Money Back Guarantee (MBG) scheme, so you can trust that we will always prioritise your interests first. Unprecedented in Singapore, learn more about our Money Back Guarantee scheme here.

Free Download of our Insurewell for smart accumulators ebook:

By clicking on the button, you agree to allow Havend to process your information and to send you emails. Havend is committed to protecting your privacy. Your email will never be disclosed to anyone. There is an unsubscribe link at the bottom of every email. You can unsubscribe anytime by clicking on the link.