Of all the enquiries that I have encountered regarding critical illness coverage, I sense that many struggle to find a coherent way to plan for it.

They would fret over the level of coverage and cite high costs of medical treatments from various sources, then try to find a match. Then when they look at the ensuing premiums needed, they will hesitate and become unsure of what exactly is the right level of coverage needed.

I feel that this struggle really stems from a mixture of facts and misconceptions when it comes to thinking about our critical illness gaps.

The facts are that increased awareness has shown us that critical illness is prevalent and medical advancement has given us the potential to treat and recover from it. Information on statistics and costs of treating various forms of critical illnesses abound.

But this may cause people to view critical illness plans in silo without considering other insurance plans. And, because critical illness plans provide a lump sum coverage, it may seem logical to simply match the payout amount against assumed costs of treatments and consider that a solution.

However, it is a misconception to think of critical illness as the main reason for high medical costs. While there is some truth in that, large medical bills can be incurred for many other reasons. A typical critical illness plan covers only diseases that are pre-defined in the contract. It will not pay out if the diagnosis falls outside the list. This limits the scope of a critical illness plan in managing medical treatment costs.

Havend’s View

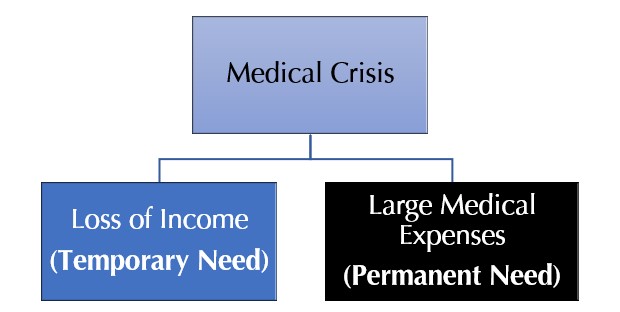

When thinking about critical illness coverage, Havend views it under a broader framework of a medical crisis event. A medical crisis can arise out of both critical and non-critical illnesses.

In a medical crisis, the resulting impact is having to deal with the uncertainty of large medical expenses and the potential loss of income due to the inability to work. The need for coverage can further be viewed as permanent (needed for whole-of-life) or temporary (needed for a fixed duration).

Dealing with Large Medical Bills

When people lament the high costs of critical illness treatment, what they are really worried about are large medical expenses that are unexpected. As mentioned, we can require medical treatments beyond just critical illnesses.

Even if we have access to published rates of treatment costs, it can still be a fruitless attempt to try and determine a critical illness coverage based on treatment costs because they vary widely depending on the type of illness.

Critical illness treatments, especially those of advanced stage, usually entail multiple treatments and may be a long-drawn process. This also adds to the uncertainty of the costs required.

Hence, addressing the concerns of large medical bills should always start with having the right hospitalisation plan in place.

In the event of critical illness, the hospitalisation plan will not only pay out for related inpatient and outpatient treatments but will also continue to provide coverage every time a medical bill is incurred, subject to certain limits. It also works similarly for non-critical illness events.

Therefore, when thinking about medical bills incurred by critical illness, it is more important to recognise that a suitable hospitalisation plan is more effective and comprehensive than a critical illness plan.

Dealing with the Loss of Income

When a critical illness strikes a working adult, he may not be able to work for an extended period. Even if his condition allows it, he may also want the option of slowing down or stopping work completely to focus on recovery.

Either way, he will face the prospect of the loss of income during this period. But regular or core expenses will continue. Even assuming that medical bills are being covered by his hospitalisation plan, he will still need to ensure that he has enough savings to maintain those expenses until he can resume work.

This is where having sufficient critical illness coverage will come in useful to supplement or replace the income loss.

The basis of assessing a suitable level of coverage will then lean on what the projected loss of income will be in the event of a critical illness and the estimated time needed for recovery. This allows us to be more objective and tailored in planning because income and expenses are unique to different individuals.

This basis also puts the control of deciding an appropriate coverage back into our hands because it is based on our own expectations of a good quality of life in the event of a critical illness and not purely on treatment costs.

Conclusion

I feel that our concern over critical illness is really a reflection of our deeper worries over the loss of control over medical costs and our ability to have enough to continue our lives as normally as possible when it strikes. I hope that by sharing our views, we can have a better starting point to target these deeper worries when planning for critical illness.

For more related resources, check out:

1. Contemplating Critical Illness Coverage After Recovery

2. Understanding the 2019 Critical Illness Standardisation and Its Impact

3. Insuring Your Health: Preexisting Conditions and Insurance Solutions