This article is a continuation of Part 1.

As we review the several types of life crisis events, we identify the five core areas of risk to transfer that are crucial to addressing these concerns. These risks persist consistently, enduring through changes in products over time.

In Havend’s guideline of insurance planning, we cover five pillars of protection, and these are areas that your insurance should address; otherwise, you would have to self-insure for any health crisis that could derail you from your life goals and financial plan.

Let us refer to Figure 6 for the five core areas of risk:

Figure 6: The Five Core Areas of Risk

Risk 1: Life

The occurrence of premature death would not only create shock and emotional sadness to your family members, but it may also have a profound financial impact on your family. This is especially true if you are the sole breadwinner, and the entire family is financially dependent on you. Areas of financial impact include outstanding loans, mortgage liability, family expenses and children’s education.

Risk 2: Occupational Disability

Disability can be caused by an accident or severe illness, leading to physical impairment or an inability to perform in your job. This could result in an occupation “downgrade,” and lead to a substantial reduction in salary. Such a situation would also have a significant impact on your family, possibly resulting in an inability to pay for your family expenses or fulfill your children’s tertiary education fund.

Risk 3: Long-Term Disability

Suffering from severe disability may necessitate long-term care, and the ongoing costs of such care are substantial. High costs are associated with the level and extent of healthcare, medicine, and treatment required. The costs of caregiving can vary, ranging from engaging a helper to home-based care and even to a private nursing home. This is an ongoing cost that could persist as long as you are still alive. Therefore, having adequate long-term care insurance could help support your family with the monthly costs incurred.

Risk 4: Critical Illness

In the event of a severe illness, there might be a need for you to take a break and focus on your recuperation, which may take several years. Unfortunately, some illnesses could relapse even after a full recovery. During this period, your family’s lifestyle, including daily expenses, bills, and financial goals, could be forced to undergo drastic changes, deviating you from your life goals. Additionally, extra costs may be incurred while seeking alternative treatments or any medical expenses that fall short of the medical insurance policy.

Risk 5: Medical

An unexpected catastrophic medical treatment can easily deplete your financial assets. Just any basic medical insurance policy may not be suitable for you. Instead, you must assess your medical needs based on your healthcare expectations and the hospital benefits. You have to manage your expectations by the level or type of policy you choose to have.

Life Cycle Planning

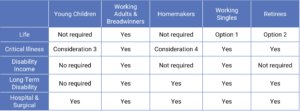

Apart from understanding the different risks in a life crisis event, it is important for you to know at which stage of your life do you require coverage for the different areas of risk. In Figure 7, we have conceptualised a general life cycle of insurance needs:

Figure 7: A General Life Cycle of Insurance Needs

- Option 1: If you have any dependents

- Option 2: If you have any legacy needs

- Consideration 3: To provide an option for parents to stop working or slow down and care for their children

- Consideration 4: To provide alternative medicine coverage or cover any potential medical expenses leakage (e.g., non-approved cancer treatment drugs)

Figure 7 is merely a guide for considering which area of risk you can transfer to insurance at different life stages. However, it may not apply to everyone’s situation. For example, scenarios such as divorce, single parenthood, caring for special needs children, and specific insurance planning needs could deviate your areas of risk from the norm.

The Support Plan

As insurance is meant to be a support plan for your main financial plan, you should first understand your immediate needs. Through identifying your needs, you can establish your planning framework for insurance. If a life crisis were to happen, not only would you suffer financially if you remain alive, but your family members could also face financial impacts. This financial strain could drastically change your family’s lifestyle, leading to examples such as:

- Having to use public transport instead of driving a family car

- Not being able to dine out at restaurants at all

- Losing the option to provide your children with an overseas education

- Requiring your children to take up study loans to fund their education

- Failing to meet your retirement goal of age 55 and having to work till you are 70

Without proper insurance policies in place, your life plans could get derailed, or even worse, they may never come to fruition. We do not wish this upon anyone—to live a life filled with regret.

Case Study: Examining the Life of Dan

Profile

Dan was the sole breadwinner, male and a non-smoker. He was 40 years old with a family of two children (one son and one daughter). He worked as a Sales Manager in a Multi-National Company (MNC) and earned an annual income of $200,000 with an estimated total savings of $100,000. He had a residential property that is valued at $1.5 million, and a family car valued at $100,000. Dan and his family did not have insurance coverage and the family expenses were about $150,000 per annum.

Unforeseen Event

Unfortunately, Dan was involved in an accident with someone riding a personal mobility device recklessly. This incident resulted in Dan falling into a coma. Although he later recovered, he was discharged from the hospital with lower body paralysis and was confined to a wheelchair. The hospital bills amounted to $300,000.

Health Impact

Due to Dan’s impaired physical state, he could no longer perform in his current occupation. His company offered him an administrative role that paid him about $50,000 per annum.

Financial Impact

Dan had to sell his family car, downgrade his residential property, and use his savings to pay his medical bills. Additionally, Dan had to reduce his family expenses by over $100,000 per year due to a reduction in his income level.

Life Impact

Dan was unable to retire early and was unable to provide tertiary education fees for his two children. His family’s lifestyle was profoundly affected.

Conclusion

In the case of sole breadwinners like Dan, it is extremely important for them to be properly insured against unforeseen life crises, which may be unpredictable. If Dan had sufficient insurance policies to cover his needs, his family’s plans and financial objectives would not have been derailed.

Guided by our philosophy and understanding of the fundamental guidelines on the risks to transfer, we can now proceed with the three steps in our insurance planning methodology: Duration, Amount, and Type.

Stay tuned next week for chapter 3 next week!

At Havend, if we are found to have oversold you, we have put in place a Money Back Guarantee (MBG) scheme, so you can trust that we will always prioritise your interests first. Unprecedented in Singapore, learn more about our Money Back Guarantee scheme here.

Free Download of our Insurewell for smart accumulators ebook:

By clicking on the button, you agree to allow Havend to process your information and to send you emails. Havend is committed to protecting your privacy. Your email will never be disclosed to anyone. There is an unsubscribe link at the bottom of every email. You can unsubscribe anytime by clicking on the link.