Is your insurance premium eligible for income tax deduction? Or are you required to pay tax on insurance payout?

In short, insurance premiums are generally not tax-deductible, and similarly, any insurance payout is also not taxable. Thus, if there is, say, a $1 million insurance payout, the full amount is tax-free, which is certainly good news!

However, there are situations where tax implications on insurance are still relevant and worth noting, especially for certain individuals as well as companies.

Tax Implication on Individuals – Life Insurance Relief

(Source: IRAS)

While insurance premiums are not deductible against your chargeable income, there is a lesser-known personal tax relief called the Life Insurance Relief that you might be eligible for to reduce your personal income tax. The limit for this relief is up to $5,000.

Who may likely benefit?

- Those who have just started working

- Self-employed individuals

- Foreigners working in Singapore

This applies to those who contributed less than $5,000 to their CPF for the year.

Eligibility

To qualify, one needs to satisfy all these conditions:

- You paid the insurance premium on your own life insurance policy. For married men, you may also claim the life insurance premium paid for your wife.

- The insurer must have an office or branch in Singapore for policies bought after 10 Aug 1973.

- The total CPF contribution to the following was less than $5,000.

a. Compulsory employee’s CPF contribution

b. Compulsory MediSave/voluntary CPF contribution as a self-employed individual.

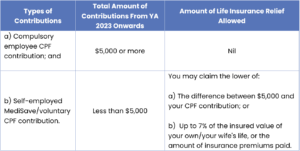

Table 1: Amount of Relief From Year of Assessment (YA) 2023 Onwards

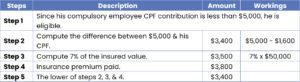

Let’s Illustrate With an Example:

In 2023, Mr Teo paid $3,800 for his life insurance with a sum assured of $50,000. His total compulsory employee CPF contribution was $1,600.

In this case, Mr Teo is eligible for Life Insurance Relief of $3,400 for YA 2024.

What Life Insurance Policies Are Eligible

For the avoidance of doubt, IRAS provided the following examples of insurance policies and riders that do not qualify for Life Insurance Relief:

- Accident insurance policy

- Hospitalisation policy

- Health insurance policy such as MediShield & Integrated Shield Plans

- Disability insurance policy such as ElderShield & CareShield Life

- Riders under life insurance policy (e.g. Total and permanent disability riders, critical illness riders, and premium waiver riders)

- Critical illness policy

- Endowment policy

- Investment-linked insurance policy with the investment component as a fundamental consideration of the policy

So, it will be whole life or term policies offering death benefits. Any riders offering benefits other than death benefit will have their premiums excluded.

Tax Implication on Company – Keyman Insurance

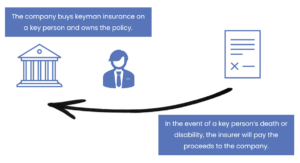

In this segment, I will focus on a certain life insurance known as keyman insurance. It is a type of coverage a company uses to protect their business against the financial impact should the key person, such as the CEO or senior management, be unable to work due to death or a disability.

In the event of a sudden loss of a key person, businesses can go through a stressful time of leadership transition, incurring huge expenses on recruitment, managing losses from business lines, and reassuring customers. Having keyman insurance in place provides the needed financial resources to get through such a pressing crisis.

To structure a keyman insurance policy, the company purchases a life insurance policy on the life of the key person and owns it. In the event of death or disability, the insurer pays the insurance proceeds to the company, which helps with the cash flow of the business.

To fulfil the fundamental purpose of keyman insurance, which is to protect against the loss of a key person, the appropriate type of insurance is term insurance. The reasons are simple: businesses typically aim to keep costs low, and the key person’s working life is limited (typically until age 65 or 70) before retirement or transitioning out of the role.

However, it is not uncommon to see more expensive forms of keyman insurance being marketed, such as whole life policies or universal life insurance. These policies have cash values and are often marketed to provide additional benefits, such as allowing the change of the key person within the policy, using the policy as collateral against loans, and even the option of transferring the policy back to the key person in exchange for their loyalty to the company. Therefore, companies and business owners need to understand what is truly important, as this will determine the type of insurance and the cost of setting it up. Would a pure keyman insurance policy suffice for the business, or are additional features needed?

Is Keyman Insurance Tax Deductible?

That depends on how the keyman insurance is structured.

For the keyman insurance premium to qualify for tax deduction, it must satisfy all the following conditions (see footnote below):

a) The purpose of the policy must be to insure the business against the loss of profits arising from the death or disability of a keyman.

b) The capital sum insured must be directly related to the extent of the annual profits directly attributable to the services of the keyman.

c) The insurance policy must remain the property of the business, and there must not be any assignment of the benefits under the policy to the insured or the insured’s family.

d) The insurance policy must not provide for a cash surrender or investment value.

e) The loss of the keyman must not affect the business’ entire profit-making structure

So basically, it has to be a term insurance to qualify for tax deduction (refer to point d above).

Conclusion

Getting the right insurance is important to protect us against financial hardship when life throws us a curve ball. And it need not be exorbitant as long as you use the right tools for the job.

Buy as much insurance coverage as you need but pay as little as you can. And it can be done. At Havend, we advocate term insurance as the most suitable way to protect yourself as it is the most affordable.

Speak to us for a review of your insurance needs with our complimentary InsureWell Assessment.

Footnote: IRAS e-Tax Guide: Deductibility of “Keyman” Insurance Premiums (Second Edition)

This is an original article written by Eddy Cheong, CEO of Havend.

At Havend, if we are found to have oversold you, we have put in place a Money Back Guarantee (MBG) scheme, so you can trust that we will always prioritise your interests first. Unprecedented in Singapore, learn more about our Money Back Guarantee scheme here.

Free Download of our Insurewell for smart accumulators ebook:

By clicking on the button, you agree to allow Havend to process your information and to send you emails. Havend is committed to protecting your privacy. Your email will never be disclosed to anyone. There is an unsubscribe link at the bottom of every email. You can unsubscribe anytime by clicking on the link.