The most recent changes to the Integrated Plan (IP) or sometimes known as the Integrated Shield Plan (ISP) caused a hot debate between the insurers and the doctors over the past 3 weeks. So, what are the issues here?

One of the biggest concerns amongst many is that if one is seriously ill, there will be an increase in medical expenses. There is a need to mitigate this financial risk. Thankfully for Singaporeans and Permanent Residents, we have MediShield Life, which covers large medical bills if we stay either in a B2/C ward of a government/restructured hospital. But if we want the option to stay in a better ward or a privately-run hospital and have the option to choose our own specialist doctors, then we will need to upgrade to an IP. NTUC Income was the first to introduced the “Shield” plan in 1994. In 2005, Aviva introduced their own “Shield” plan that has “as-charged” feature and also full riders that will pay for the deductible (the initial amount that one has to pay for his medical expenses before his Shield plan makes a payout) and co-insurance (the amount one has to co-pay or split the cost with the insurer after he pays the deductible). Essentially, with the full rider, one’s medical bills will be fully paid by the insurer and he doesn’t have to fork out any money. Subsequently, other insurers followed and we witnessed a rise in IP premiums in the years that ensued.

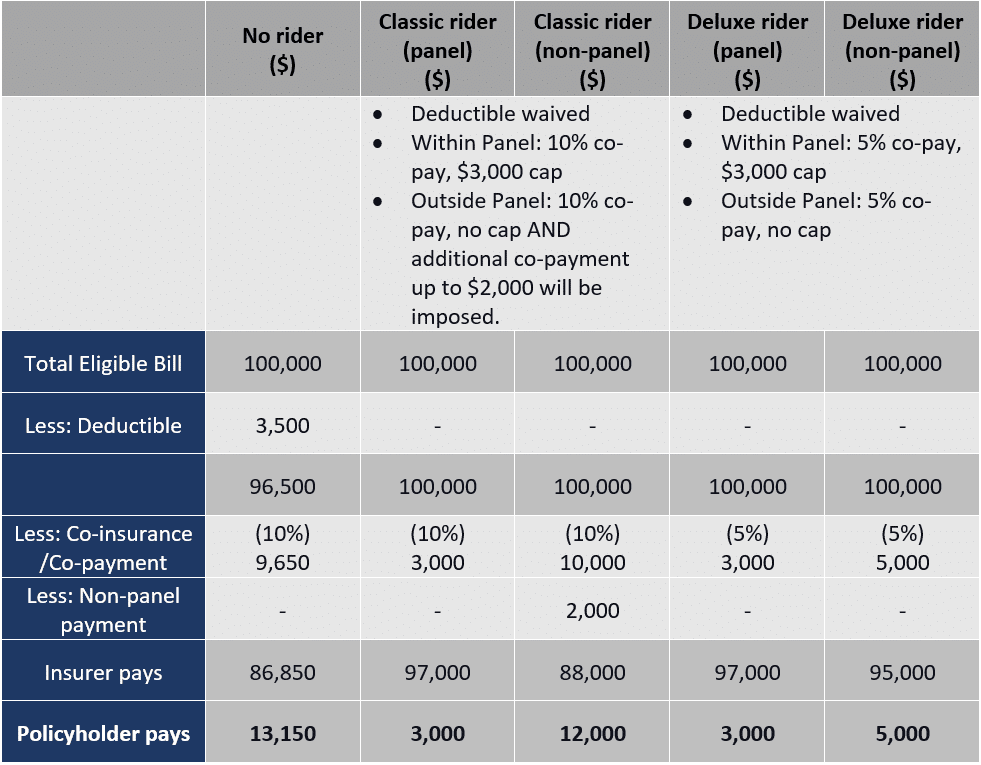

In 2018, Ministry of Health (MOH) announced that from 1 Apr 2019, no more full riders would be sold to new buyers of IP. Existing policyholders with full riders could still keep their full riders if they choose to but new IP buyers can only buy the so-called “partial riders” that will require policyholders to co-pay at least 5% of the bill but capped at $3,000 if policyholders see doctors from the insurers’ panel (panel doctors). If one sees a non-panel doctor, there will be no cap to the co-payment.

But most recently, it was announced that from 1 Apr 2021, even for existing policyholders who have full riders, it will be converted to partial riders on their next policy renewal. The private sector doctors were unhappy with the IP insurers for excluding many private specialists from their panel. The insurers defended themselves to say that this was done to reduce costs and premiums. The doctors fought back and said that the IP insurers should first take a “hard look” at how it justifies its management and commission (distribution) costs to manage premiums increment. Over the past weeks, opinions have been exchanged on who should bear the responsibility of the premium increase but instead of focusing on the debate, which we really have no control over the outcome, I feel that it is more important for consumers to understand the implications of the changes and what we should do about it.

Due to space constraint, I will only use NTUC Income’s (among the biggest IP insurers) Enhanced IncomeShield to draw out some of the implications. When an existing Enhanced IncomeShield policy holder renews his policy, if he has the existing full rider (Plus rider), it will automatically be converted to the new Deluxe rider. Those with existing partial rider (Assist rider) will automatically be converted to the new Classic rider. There are a few major implications here.

Ensuring that the rider you have is aligned with your healthcare expectation

Looking at table 1, it tells us that if we are sure that we will only use panel doctors (doctors from government/restructured hospitals or selected doctors in private practice), Classic rider may be sufficient. But if we want the option to visit non-panel doctors, having Deluxe rider is important. Of course, if we are able and willing to set aside some cash to pay for the deductible and co-payment, we may not need to buy the rider. But the point really is that we should review the rider we have or the rider that we will automatically be converted to, to ensure that it is aligned with our healthcare expectation.

Knowing if you can afford the premium

Taking a quick glance at table 2, we can see the premium differences between the Classic and Deluxe riders across the age bands can be in the range of about 50%. So, while we may want the best rider, we need to assess our willingness and ability to pay the extra premiums.

Breadth and depth of panel doctors

I took a quick look at just 10 different disciplines on the panel of doctors from different insurers and the range is wide. Between them, the difference can be in the hundreds. But while breath is important, depth is important too. As an example, there are many subspecialists in the say, orthopedic space (like spine specialists or knee specialists) and that may be an important consideration for you. While it is possible that insurers will continue to add more doctors onto their panel over time, checking if your existing doctor is currently on the panel may be important for you.

There are many other considerations in deciding if your new rider or maybe even your current IP is suitable for your needs, but space constraints does not allow me to highlight more. And I am only using one insurer to draw out the implications here. My point really is that as consumers, we need to focus on the main thing instead of the noise. The implications to the recent IP changes may have been underestimated so please don’t do nothing. Speak to your trusted adviser for a review.

The edited version of this article has been published in the Money Wisdom Column of The Business Times Weekend on 24th April 2021.

For more related resources, check out:

1. Insuring Your Health: Preexisting Conditions and Insurance Solutions

2. Unveiling CareShield Life in 2020: Impact and Implications for You