Most of us own whole life insurance plans. They are meant to protect us against death, disability or a major illness for our entire life. But do we really need insurance cover for our entire life?

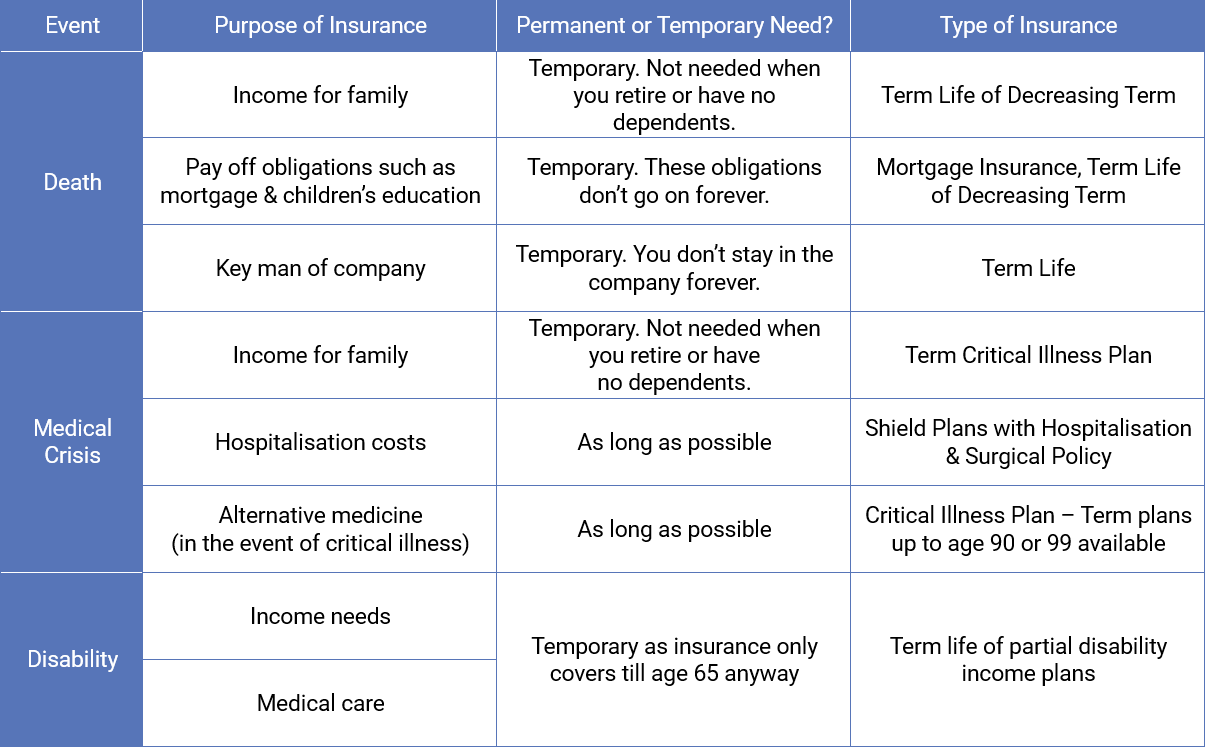

From table 1, it becomes clear that most of our protection needs are temporary, with the exception of providing for hospitalisation costs and maybe say, alternative medicine. Insuring against high hospitalisation cost can be done effectively using medishield or a private shield plan with a good hospitalisation & surgical plan that pays the first dollar that you incur. To provide for the need of alternative medicine such as Traditional Chinese Medicine in the event of a critical illness, you can buy a small term plan that covers critical illness till age 90 or 99. All insurance companies in Singapore sells Term plans covering death, disability, critical illnesses, long term care and mortgage protection.

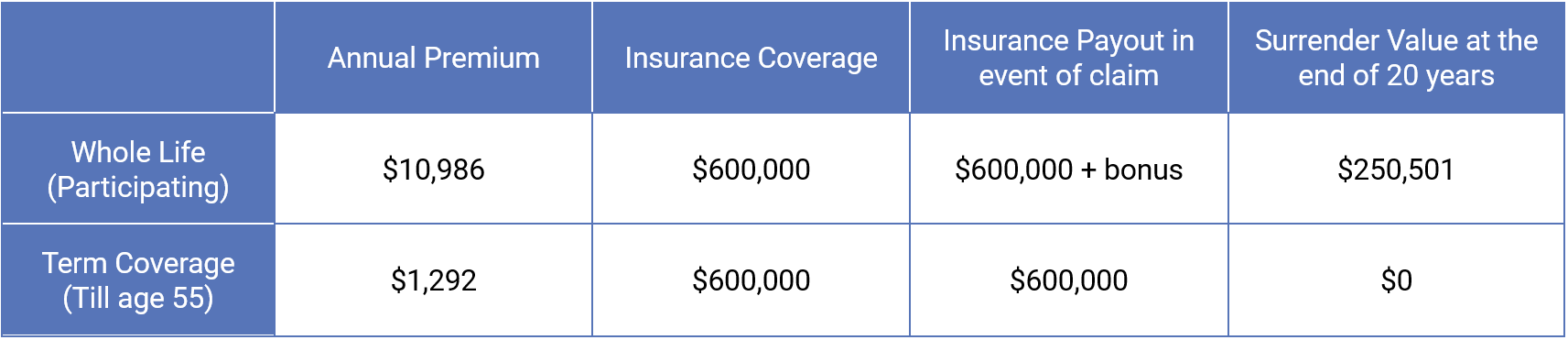

Thus most of us do not really need whole life insurance. By purchasing one, you are paying huge premiums and most of time not being fully insured. To illustrate, if you are 35 years old man and need to provide your family with a monthly income of $3,000 for 20 years in the event of your unfortunate demise, you will need about $600,000 cover. If you intend to retire and have no dependant at age 55, Table 2 shows a comparison for the various types of plans:

The truth is, how many can afford to pay $10,000 per year, just to cover his individual death needs? In the above example, we haven’t even considered his medical, his spouse, and his children insurance needs yet. With term plans, we can afford to fully cover our needs. Of course, advocates of Whole Life plans will say that you get some returns on the premiums you pay from Whole Life insurance whereas, from term plans, you get nothing back at the end of say, 20 years. That is only half-truth! This is because; there is a portion of your premiums for whole life plans that will be expended. Only after that, will the money be invested. But what is the point of the cash values when you can’t even get your whole family covered properly?

In the above example, the difference in premiums is $9694 p.a. and in return, you get about $250,000 at the end of 20 years. That is just an annualised return of 2.38%. It is said that Singaporeans are sold mostly whole life plans. In 2003, only 7.3% of the total insurance policies sold are Term plans. No wonder Singaporeans are generally underinsured. So let’s use insurance for the right purpose, protection. Even if savings are important, there are a lot of options (which is beyond the scope of this article) to better the 2.38% p.a. as in the above example. So, think twice before you pay your next insurance premium. Don’t just take what is being sold to you.