Sometime in September last year, The Business Times reported that the average insurance coverage of a Singaporean is equivalent to only one year of his/her income. And according to an OCBC survey as reported in The Straits Times dated 20 June 2002, one in three Singaporeans are not covered by insurance. The survey went on to show that more than 80% of the respondents to the survey cited shocking reasons why they were uninsured. 39% said they had either no money or no budget for it. 28% said it was not important and unnecessary and 16% said that they had no reasons, or were unsure for the lack of cover. The state of our under-insured situation is shocking, considering that Singaporeans are generally well educated and we are a nation with relatively high per capita income. In this short article, I hope to show how important it is for us to cover ourselves adequately, especially in a medical crisis, and how you may not have to spend too much money getting good cover.

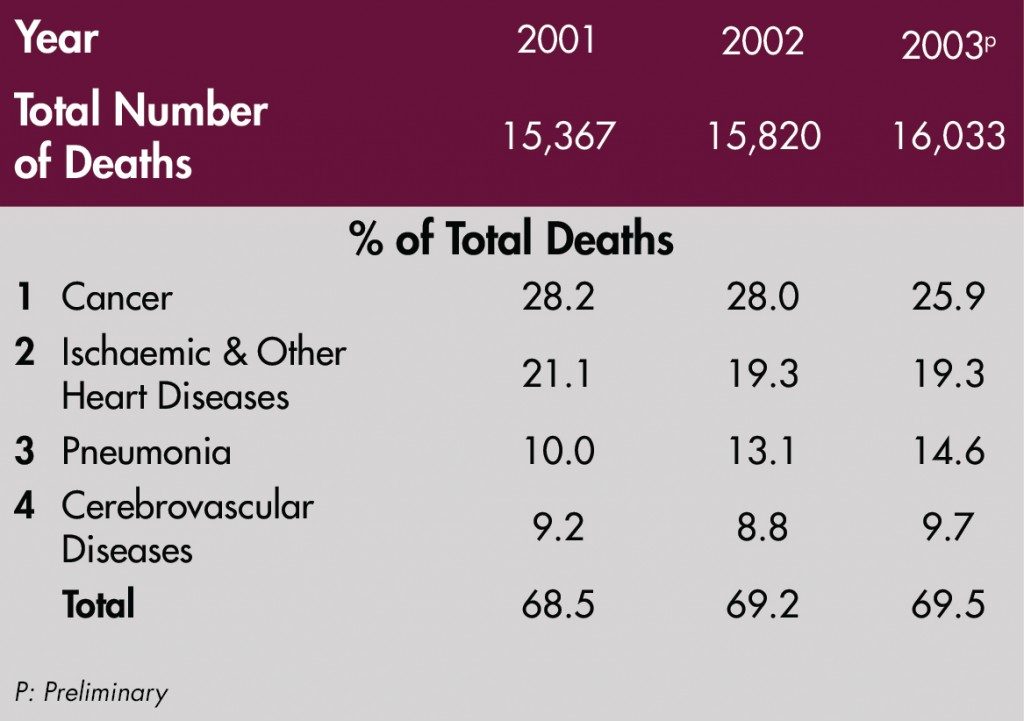

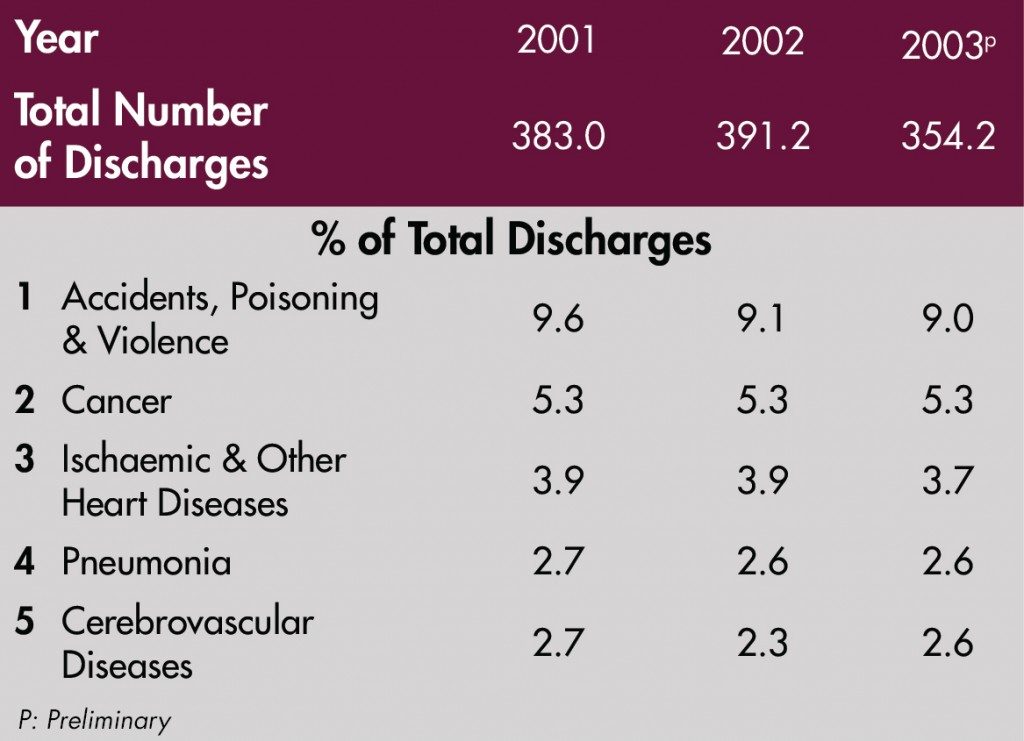

According to the Ministry of Health Website, more than 2 out of every 3 Singaporeans died due to major illnesses such as cancer, heart diseases, pneumonia and stroke (Table 1). These same 4 top killers in Singapore are also the main reasons for hospitalisation (Table 2). Furthermore, the one time cost and recurring cost of treating these illnesses is a huge amount. These reasons are sufficient to encourage me to cover myself adequately, in case a medical crisis hits me.

So what is an adequate medical cover? As much as possible since I’ll never know what disease I may get and how long it will last? Not really. By adequate cover, it means having a comprehensive medical programme that will ensure you of no out of pocket expenses during a medical crisis, to allow you to live normally until your situation stabilises.

Generally speaking, in a medical crisis that involves a critical illness such as cancer, heart diseases, etc, there are 2 main financial impacts:

1. Loss Of Income

To be fair to your employer, there is a limit on how long they can pay you when you can no longer work. There may come a time when your income will cease. But, because you will still need to support your family’s lifestyle like putting food on the table, paying for mortgage, supporting your kid’s education and so on, you need to replace this loss of income. Unless you have a huge amount of cash in your bank account, there may come a time when you have to make major adjustments to cut your expenses. This may not be ideal, especially at this time when you are seeking medical treatment, require lots of rest and are not in the best position to make such important decisions.

2. Increased Expense Due To Medical Care

The cost of treatment for a critical illness such as cancer and heart diseases is very high. And after that initial treatment, you still have recurring medical cost to worry about. If you do not plan for such a possible expense, you may conquer the disease and live, but you may also leave for yourself and your family huge medical debts to clear.

So how can you cope with this possible expense? The simple answer is to structure for yourself a cost-effective comprehensive medical programme. Many times in my course of work, it surprises me to see so many people paying premiums and yet not having a comprehensive cover.

- Protecting Against Loss of Income

Generally speaking, one should provide for at least 2 to 3 years of gross income in the event that we suffer a critical illness. The rationale for this is as follows: Assuming we should pass away as a result of the illness, we would already have left behind sufficient insurance proceeds (assuming you have planned properly and bought sufficient death coverage insurances) to take care of our surviving family members. If we should, fortunately, survive the illness, 2 to 3 years of income would be sufficient for us to be financially stable so as to make plans for our financial future. To address this potential loss, you should therefore consider purchasing critical illness, or some insurers call it, dread disease insurance. So for example, if you are earning $100,000 p.a., you should have about $200,000 to $300,000 dread disease insurance. In our opinion, the first $100,000 can be a whole life non-participative plans or “lifetime” term plans that cover you till age 90 or 100. The rest of it should be covered by term plans till your planned retirement age. If you are conservative, you may include a buffer of an extra 5 years after your planned retirement age.

The reason for the above is such that if you do plan and execute your investment plan in a proper manner when you eventually retire, you should no longer require any income replacement cover since you would already have a tidy nest egg to see you through even if you fall ill. However, you may wish to retain the first $100,000 cover throughout your entire life to provide as a buffer to pay for alternative medicine such as Traditional Chinese Medicine, which is currently not covered by insurance.

- Providing For Medical Expenses

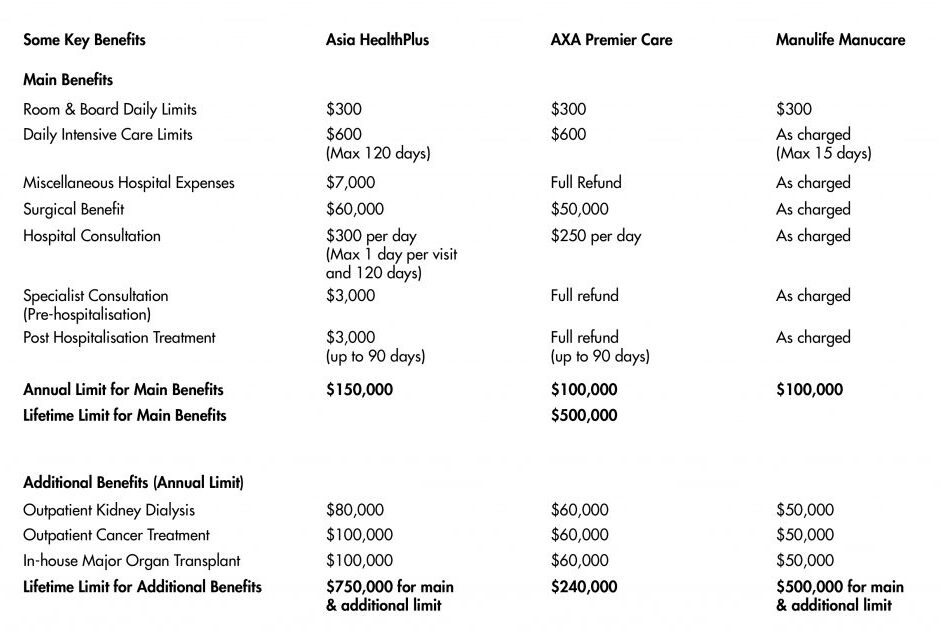

Besides having medishield, you should have good Hospital & Surgical (H&S) Insurance cover. Good H&S insurance is one that will allow you good medical care without much out of pocket expenses. Table 3 shows a brief summary of 3 better H&S programmes in Singapore.

So, how much would it cost you to have a good medical package? If you are age 35 and a male non-smoker, it will cost you about $3,140 p.a. If you a female non-smoker, it will cost you about $2,961 p.a. Not too bad considering the comprehensiveness of your medical cover. Even if you are hospitalised for a minor illness, the programme will potentially ensure that you do not have to come out with cash to foot your medical bills. With a good understanding of your needs, and with careful planning, you and your family may not have incurred huge premiums and still have the peace of mind.