I recently did a podcast on insurance planning and was surprised by the overwhelming response. While consumers were generally thankful for the information, I was taken aback that some advisers were still unhappy with us advocating that term plans are the more suitable form of insurance for most situations. So let me once again revisit this age-old debate on term plans vs whole life insurance or rather, temporary vs permanent need of insurance.

Good insurance planning must begin with first deciding (1) How long you need your insurance (temporary or permanent) and (2) How much of it you need before deciding (3) What type of insurance to buy.

How long do you need insurance (temporary or permanent?)

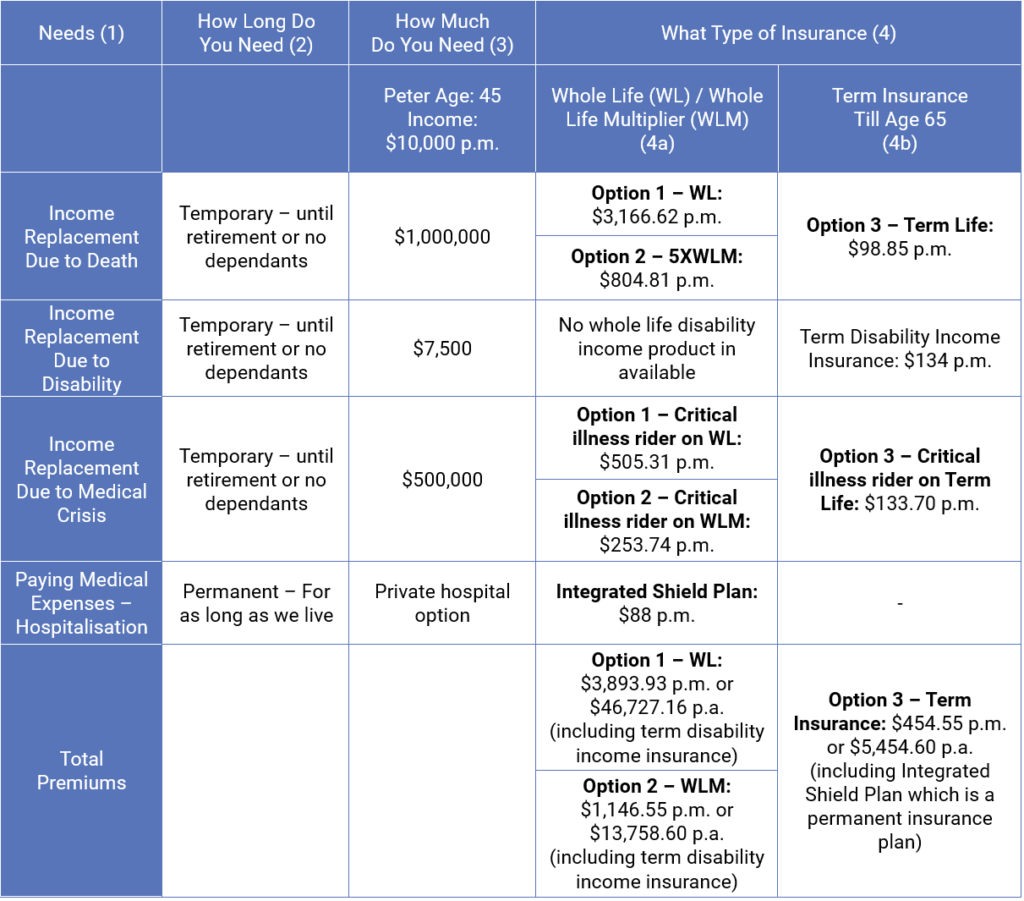

If you look at the second column of the table below, you will realise that if you are buying insurance to replace your income loss in the event of your unfortunate death, disability or medical crisis, you will only need temporary coverage. This is because there will come a time when you will no longer earn an income (retired) and/or when you have no more dependants (your kids have grown up and/or parents have passed on). In this case, there is no need for your income to be replaced and thus no need for insurance coverage. But if you are buying insurance to pay for medical expenses, then you will need to be covered for as long as you live.

How much insurance coverage do you need

Due to space constraints, I will not explain how one can calculate how much insurance is needed. I will simply assume that our fictitious character Peter, will need the amount of insurance coverage as stated in column 3 of the table below. Suffice it to say that based on Peter’s income, they are realistic.

What type of insurance to buy

Column 4 in the table below shows three options to cover Peter’s needs. In column 4a, whole life (WL) and whole life multiplier (WLM) products are considered whereas in column 4b, we use term insurance. WLM is essentially a whole + term life insurance bundle that many insurers are offering today.

Using the example of a 5X multiplier here for Peter, the WLM is actually bundling a $200,000 whole life and an $800,000 term life till age 70 products together. So if Peter passes on or is diagnosed with a dread disease before age 70, $1 million will be paid. If death or the diagnosis of a dread disease happens after age 70, only $200,000 will be paid.

Column 4 also shows all the products from various insurers in Singapore with the premiums based on the amount of insurance Peter needs. It is clear that since most of Peter’s need for insurance is temporary (except for paying medical expenses due to hospitalisation) till he retires and/or when he has no dependents, term insurance is the most suitable.

Term insurance is also the most cost-efficient and effective. The only permanent insurance that Peter needs will be the Integrated Shield Plan and should he want the option of paying for alternative care (not shown on the table here due to space constraints), a critical illness rider on a whole life or whole life multiplier insurance of say about $100,000 sum assured can be bought.

I have often been told that advocating that term insurance is the most suitable for most situations is too simplistic as “one size doesn’t fit all”. On the contrary, this philosophy has been deeply thought through and tested over time. While it is true that the amount of coverage as well as the type of needs for insurance may vary for different people (indeed one size does not fit all), as long as one’s insurance needs are temporary, term is always the clear winner.

Also, the primary purpose of insurance is for protection and not for savings or investing. For if one wants to save or invest, there are many better options available. Using insurance is a very expensive way to save and invest especially due to its high distribution cost. And since the objective is protection, then term insurance is the most affordable way to be comprehensively and fully covered.

As you can see from the example given, you will need to pay a lot more per year to be fully covered with Whole Life or Whole Life Multiplier. And because most people cannot afford or do not want to pay for it, they are left underinsured. If they pay for it despite being unaffordable, they will have insufficient money to live a life now and accumulate for their future objectives.

That is why our insurance philosophy has been that when it comes to insurance planning, “buy as much as you need but pay as little as you can”. That to us is wisdom.

For more resources, check out:

1. Navigating the World of Financial Products for Your Newborn

2. The Truth About Using Insurance for Wealth Accumulation

We are excited to announce that we have officially launched our InsureWell for Smart Accumulators eBook, which you can download here.

Havend wants to be a safe place where our clients can fully trust us for their insurance needs. We have put together many measures to mitigate the inherent conflict of interest in insurance sales, and our Money Back Guarantee is a promise to demonstrate that our client’s needs will always come first. You can watch this video to find out more.

Learn more about:

▸Our philosophy here