Philosophy

Having a robust philosophy is of great importance as it guides us to set forth a belief, a doctrine, a framework, and a guideline to put into practice when it comes to insurance planning. It provides the groundwork for the commencement of proper insurance planning and implementation. A robust philosophy also sets a consistent and professional advisory standard for an insurance firm. At Havend, our belief is that insurance is primarily used as a risk mitigation tool, also known as protection. Since the primary use of insurance is for protection, you should buy only as much insurance as you need and spend as little as you can.

In theory, the word ‘protection’ can be broadly used for anything. In your case as our client, it is protecting your financial position in the event of a life crisis, for example, sudden or premature death, suffering from dread diseases or disability from a major accident or illnesses.

Most of us have limited resources – money for daily expenses and lifestyle (hobby, entertainment, etc.), retirement savings, or supporting dependents like our elderly parents or young children. Therefore, it is not advisable to over-budget for insurance because there is no end to what you can cover. An illustration of this situation could be having more than ten fire extinguishers in a HDB flat, where you might not use all ten extinguishers in the event of a fire breakout, resulting in an over-commitment to such protection devices.

On the other hand, overspending on insurance does not necessarily mean that you are adequately protected. In some situations, you could still be underinsured or not insured at all for certain risk areas in a crisis. For instance, overspending on expensive whole-life policies without obtaining enough sum assured to adequately cover yourself.

Hence, applying a robust guiding framework on how we should plan for insurance is important, as you can now minimise the resources used on insurance and free up financial resources to achieve your life goals. Such goals can include accumulating for retirement, funding your children’s tertiary education, or living a life that you are enjoying now. Ultimately, insurance is something that you do not wish to use but hope that it is there when you need it.

The Purpose of Insurance

The main mechanism of insurance is risk pooling. Individuals subscribe to the insurance policy by paying a small amount of premium, and in return, when a life crisis hits, a portion from the pool of premiums collected is then used to pay out to the unfortunate one. This way of de-risking a life crisis is called risk transference. There are many methods to de-risk different situations, and insurance is one of the most effective methods. The mechanism behind this is that everyone tends to assume that the likelihood of a life crisis occurring is low, as everyone wishes to lead a normal and healthy life. However, when such an event does happen, the financial impact is substantial.

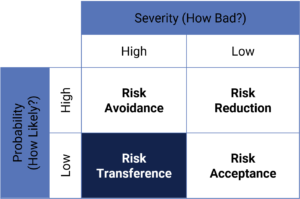

There are several methods when it comes to risk management tools – risk control and risk financing. Insurance is a form of Risk Transference through using a risk financing method. How and when you manage risk is dependable on different scenarios. Figure 1 shows an example of how risk is being managed in different scenarios.

Figure 1: How Risk Is Being Managed in Different Scenarios

Different Methods of Managing Risks

With reference to Figure 1:

Risk Avoidance (example: Bungee jumping)

If we know that certain acts like bungee jumping may lead to suffering a bad injury or even death with a high financial impact due to medical costs or even being unable to perform our own occupation, you should avoid it rather than transfer the financial impact risk to insurance. If you are to cover this risk, it will be very expensive, and in some cases, insurance companies may not even offer the coverage.

Risk Reduction (example: Roller skating)

Roller skating is a common sport in Singapore, but without proper care, it can lead to injuries, usually not too serious. Hence, wearing protective gear reduces the likelihood of bodily harm in the event of an accident, subsequently reducing the financial impact from medical expenses.

Risk Transference (example: Dread disease such as heart attack, stroke, cancer)

Not everyone will experience a dread illness during their working years, but if it does happen, the financial impact can be catastrophic due to the loss of income or high medical expenses. To mitigate such financial impact, outsourcing the risk to a third party, such as an insurance company, by paying a small premium to cover a significant monetary value, can help cushion these financial losses.

Risk Acceptance (example: Common illnesses such as flu, fever, cough)

An event that has a low chance of happening and when it happens, it would cause a low financial impact. In such cases, there is no need to further reduce the risk of such events and to simply accept that such risks could occur in your life occasionally.

In general, not every risk can or should be transferred to insurance. An understanding of insurance is required to be able to identify which are the major types of risks that may cause calamitous or serious loss. Once such risks are identified, you should consider transferring that risk to insurance.

You can read part two of this article here.

At Havend, if we are found to have oversold you, we have put in place a Money Back Guarantee (MBG) scheme, so you can trust that we will always prioritise your interests first. Unprecedented in Singapore, learn more about our Money Back Guarantee scheme here.

Free Download of our Insurewell for smart accumulators ebook:

By clicking on the button, you agree to allow Havend to process your information and to send you emails. Havend is committed to protecting your privacy. Your email will never be disclosed to anyone. There is an unsubscribe link at the bottom of every email. You can unsubscribe anytime by clicking on the link.