This article is a continuation of Part 1.

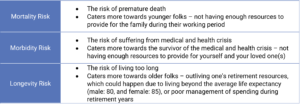

There are several types of risks in a life crisis event that insurance covers. Let us have a look at what types of risk we can transfer to life insurance:

Figure 2: Types of Life Risks

The longevity risk type will not be covered in this eBook, as it would be a huge topic that relates more towards a retirement strategy and investment philosophy. Therefore, let us instead look more in-depth into the risk management of the mortality risk and morbidity risk types of life risks. There are many different types of insurance coverage; however, not all are equally important as it is impossible to cover everything. Hence, it is best to focus on the most important areas that would have the most financial impact on you, should an unfortunate event happen.

- Life coverage

- Disability income coverage

- Critical illness coverage

- Health insurance (hospital & surgical) coverage

- Long-term disability coverage

Insurance products have evolved over the past decades, especially in the whole life policies, endowment policies as well as investment-linked policies (ILP) segments. At Havend, our insurance philosophy remains relevant in today’s context – insurance should not be your main plan but, instead, function as a support plan for your life goals. Its role is best defined as a contingency measure, providing financial support when confronted with a significant life or health crisis.

So, What Is Considered the Main Plan?

In financial planning, the most important aspect is to first identify your life goals at various stages in your lifetime before making any financial decisions. By first having a wish list for your life goals or financial objectives, it will be easier for you to find the most suitable financial tools to support your decision. In most cases, achieving life goals or financial objectives will require a certain amount of funds to fulfill them.

There are many ways to build wealth, and one way is through investing. Investing provides the most efficient way for wealth accumulation and depending on your risk tolerance and comfort level, the sky is the limit. However, we will leave the topic of investment out because it diverges from insurance, which is the core topic of this eBook.

You can read chapter 2 here!

At Havend, if we are found to have oversold you, we have put in place a Money Back Guarantee (MBG) scheme, so you can trust that we will always prioritise your interests first. Unprecedented in Singapore, learn more about our Money Back Guarantee scheme here.

Free Download of our Insurewell for smart accumulators ebook:

By clicking on the button, you agree to allow Havend to process your information and to send you emails. Havend is committed to protecting your privacy. Your email will never be disclosed to anyone. There is an unsubscribe link at the bottom of every email. You can unsubscribe anytime by clicking on the link.