You can read chapter 3 of our eBook here.

Understanding the amount of coverage that you need can be tricky as different individuals may approach the coverage calculation (sum assured needed) differently. However, there is no right or wrong way to any of the methods. In this chapter, we have identified a few common methods for calculating your required coverage and the preferred approach adopted by Havend.

Figure 16 shows an example of the common methods used for calculating the sum assured:

Figure 16: The Common Methods Used for Calculating the Sum Assured

1. Multiple-Of-Income Approach

One of the most common methods used for calculating the sum assured is using the multiple-of-income approach, also known as the multiply approach. This involves either a multiply approach based on the number of years of your annual income or based on your age-band income multiplier.

Here is an example of a multiply approach using annual income:

- Annual income: $50,000

- Duration of coverage required: 10 years

- Sum assured required: $500,000

Another example of the multiply approach using an age-band income multiplier:

- Annual income: $50,000

- Current age: 40

- Retirement age: 60

- Duration of coverage required: 20 years

- Sum assured required: $1,000,000

While this method is quick and easy to calculate your sum assured, it may not be suitable for your unique needs or situation. Due to its overly simplistic nature, it is better to use it as a gauge to get a sense of the premium and if it fits your budget. Additionally, using this method does not consider using the sum assured payout to invest, nor does it consider inflation nor factor in your current financial position to self-insure. It could also be a double-edged sword, potentially leading to either over-insurance or under-insurance, with the actual financial impact becoming evident only over time.

2. Capital-Based Approach

Another common method is using the capital-based approach. It is based on your annual income required to sustain living expenses for your family by utilising the investment return on capital required to calculate the sum assured. In simpler terms, if you were to pass away, the insurance company pays out a lump sum of money, which is then invested to provide passive income for your family’s household expenses.

Here is an example of a capital-based approach for calculating the required sum assured:

- Annual income for the family: $50,000

- Yearly investment return to generate the income: 5%

- Sum assured required: $1,000,000

This is another example of a capital-based approach with a lower investment rate of return:

- Annual income for the family: $50,000

- Rate of investment return to generate the income: 3%

- Sum assured required: $1,500,000

The calculation of the sum assured required through this method can be subjective, as it depends on the rate of return from the investment according to your expectation. If the expected return is higher, the sum assured will be lower. Conversely, if the expected return is lower, the sum assured is expected to be higher.

While this method is quick and easy for obtaining a premium amount, it may not be cost-effective if the insured amount is very high. Also, the return payout from the sum assured will be fixed and does not consider inflation. When estimating the rate of return from the investment, it is better to be prudent and not overly optimistic, as being overly optimistic could lead to being inadequately insured in the event of a financial impact on your family.

3. Capital and Income Needs Approach (CINA)

At Havend, we adopt the capital and income needs approach, which is more apt to address your specific financial situation and unique needs. This approach involves a more holistic assessment by considering factors such as personal assets, liabilities, and existing insurance coverage. Additionally, we use an inflation-adjusted return method to calculate the outcome, which may reveal surpluses or shortfalls in your coverage.

While this method is more complicated when compared to the two earlier methods, it has proven effective in meeting the specific needs of individuals.

Here is an example of how we apply a capital and income needs approach, based on these considerations:

- Annual income

- Family income required for household spending and expenses

- Required children’s education funds

- The value of assets for liquidation such as CPF, stocks & shares, unit trust, fixed deposit, saving account, investment property

- Liabilities that would incur upon death such as tax, mortgage loan, credit card loan, vehicle loan, personal loans

- Expected inflation rate

- Expected investment return to net off the expected average inflation

- Final expenses upon death such as hospital, funeral, legal and probate expenses

- Existing insurance policies

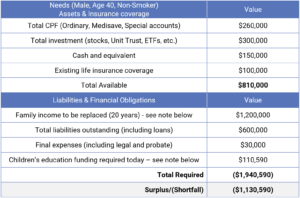

Our planning approach is to first estimate the size of the estate (or assets) by adding up all your assets, excluding your residential property (as the family would need a roof over their heads), and after including insurance payouts upon death. This represents how much is available for distribution.

Next, we would estimate the size of your distribution needs in terms of your liabilities to repay, any financial obligations (such as the funding of children’s education), providing income for the family, as well as covering final expenses.

Thereafter, this approach would determine if there is any gap in provision in the event of death.

Figure 17 demonstrates how we calculate the death needs assuming the tabulated information is provided by the insured:

Figure 17: A Calculation of Death Needs

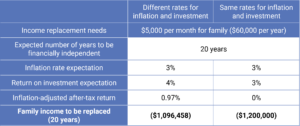

Note on Replacement of Family Income

The primary purpose of using an inflation-adjusted return calculation for family income is to derive a more accurate estimate of the shortfall if required. However, for simplicity, we could also assume a flat rate (i.e., the same inflation and investment rates) if it is more appropriate.

To explain this in detail, please refer to Figure 18.

Figure 18: An Inflation-Adjusted Return Calculation for Family Income

Note on Children’s Education Funding

Over the years, we have consistently updated tertiary education fees to include education inflation in popular countries such as Australia, the United Kingdom, and the United State of America, as well as our local Singapore universities. In addition to university fees, we have also factored in the cost of living overseas, rental expenses, and other miscellaneous costs, for our children to live and study comfortably overseas.

In part 2 of this chapter, we go through a case study of Dan, comparing the sum assured required using the 3 approaches above.

At Havend, if we are found to have oversold you, we have put in place a Money Back Guarantee (MBG) scheme, so you can trust that we will always prioritise your interests first. Unprecedented in Singapore, learn more about our Money Back Guarantee scheme here.

Free Download of our Insurewell for smart accumulators ebook:

By clicking on the button, you agree to allow Havend to process your information and to send you emails. Havend is committed to protecting your privacy. Your email will never be disclosed to anyone. There is an unsubscribe link at the bottom of every email. You can unsubscribe anytime by clicking on the link.