You can read part 1 of this article here.

Scenario

Using the earlier case study: Dan, a sole breadwinner, male, age 40, non-smoker, with a family of two children, working as a sales manager in an MNC and earning an annual income of $200,000.

Assuming that this is Dan’s financial situation:

- Family income required: $120,000 per year

- Aims to retire at age: 60

- Years of family income required: 20 years

- Cash saving: $100,000

- CPF total value: $100,000

- Residential property value: $1,500,000

- Family car value: $100,000

- Total investment assets: $500,000

- Total liabilities: $1,000,000

- Annual investment return expectation: 2%

- Inflation rate expectation: 2%

- Children’s education funding shortfall: $250,000

- Existing insurance: $0

- Final expenses: $30,000

Dan wishes to purchase life insurance and is exploring different methods for calculating his coverage.

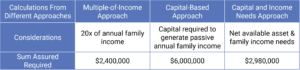

Figure 19: Calculations From Different Approaches For Sum Assured Required

Given the calculated sum assured, if Dan uses the multiple-of-income approach, he would be under-insured, as his needs are based solely on family income without considering existing liabilities and shortfalls in his children’s education funding. Moreover, this methodology does not account for interest rates and relies purely on drawing from the bank account for his required family income.

While the capital-based approach would provide Dan with a higher sum assured, the primary focus is using the capital as a base for investment and utilising dividend returns to cover family income needs. Although this method may provide a form of passive income for Dan’s family, the drawback lies in a shortfall in repaying liabilities and funding his children’s education, and it is expensive to pay for such high coverage.

Havend applies the capital and income needs approach because it considers all assets and liabilities, including Dan’s family expenses and life goals, such as his children’s education, which requires a sum of money in the event of his early demise. This approach provides Dan with an accurate assessment of the coverage needed, offering higher certainty that he will be more financially prepared in the event of a premature death, especially for sole breadwinners. Through this approach, Dan will be safeguarded across all aspects in the occurrence of a family life crisis.

Premium Comparison

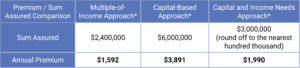

Based on the calculations above, do you wonder how this would affect Dan’s insurance planning? Figure 20 shows the comparison of premiums between the three types of planning approaches through term policies:

Figure 20: Calculations From Different Approaches For Annual Premium

*Refer to Annexes in the eBook, which you can download in the link below.

Based on Figure 20, the multiple-of-income approach provides the lowest premium. However, this method may not adequately address Dan’s needs. The capital-based approach, on the other hand, has the highest premium among the three approaches. Dan would be allocating double his resources compared to the other two approaches for coverage he may not necessarily need. To strike a balance between securing adequate coverage and maintaining a sustainable budget for insurance, the capital and income needs approach emerges as a better solution. It comprehensively covers all aspects without over-insuring Dan, thereby preventing him from incurring higher premiums.

In part 3 of this chapter, we discuss how much Critical Illness insurance is required, so do give it a read. If you would prefer to read all the chapters in their entirety, download the full eBook below.

At Havend, if we are found to have oversold you, we have put in place a Money Back Guarantee (MBG) scheme, so you can trust that we will always prioritise your interests first. Unprecedented in Singapore, learn more about our Money Back Guarantee scheme here.

Free Download of our Insurewell for smart accumulators ebook:

By clicking on the button, you agree to allow Havend to process your information and to send you emails. Havend is committed to protecting your privacy. Your email will never be disclosed to anyone. There is an unsubscribe link at the bottom of every email. You can unsubscribe anytime by clicking on the link.