Two months ago, I wrote an article on this column revisiting choosing the right insurance: a look at term versus whole life. The conclusion was that in most situations, term insurance is the most suitable. As expected, not everyone agrees with that position. The crux of their objections was that when you buy term insurance instead of whole life plans, there is no cash value. So, let’s look at 5 of the common objections associated with having no saving component to an insurance policy.

“You are wasting your money because you get nothing back”

For every premium dollar you pay for your whole life plans, a portion of it goes into paying the cost of insurance and the rest of it is invested into the insurer’s life fund. The cost of insurance portion is never returned to you. The only reason why you get money back from a whole life plan after a period of time is because you gave the insurers extra money to invest in their life fund. When you buy a term plan, you are effectively paying only for the cost of insurance and that is why you get no money back at the end of the term. So while this claim is true, it is only a half-truth.

“You are not saving towards your retirement”

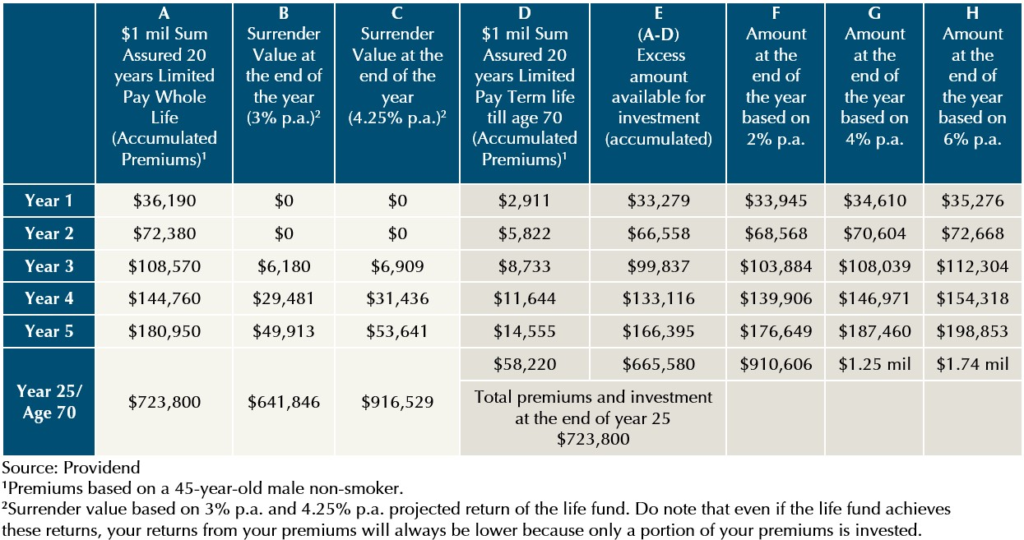

Because you are buying only pure insurance with no extra money given to the insurers to invest for you, you are not saving towards your retirement, so the argument goes. But from column B and C of the table, you will see that even after 25 years, your whole life policy has barely broken even from the total amount of premiums paid. Yes, you might have accumulated a sum of money but with no or almost no returns. Instead, if you simply buy a term plan and invest the amount saved from buying a whole life plan (column E), even at 2% p.a. (F), you would have done better. In addition, there is flexibility when you “buy term and invest the rest”.

- If a better and lower premium term plan comes along in the future, or for some reason you do not need insurance coverage anymore, you have the option to change or terminate your term plan without affecting your savings.

- If you need money in the short term, you can always cash out your saving component without affecting coverage.

“Your policy will lapse if you forget or cannot afford to pay premiums”

The argument is that this will not happen in the case of whole life plans because under the non-forfeiture clauses of whole life plans, you can service the premiums of your policy by using the accumulated cash values. But the question is, are you willing to pay $33,279 p.a. more just to solve this problem? There are more cost-effective ways to mitigate this risk. Firstly, you can set up a direct debit arrangement or standing instruction with your bank to automatically pay your premiums. Even if your account has no money, you still have 30 days of grace to pay and if you have a good agent, he will be informed of your non-payment and should remind you to do so. On the issue of affordability, I think you have a higher chance of not being able to afford the expensive premiums of whole life than the cheaper premiums of term plans. And if one really cannot afford the premiums due to, say, a temporary loss of job, he can always dig into his accumulated invested amount. So, I find this objection to be the most absurd.

“Not everyone knows how to buy term and invest the rest”

This is true. But if the person who wants to sell you a whole life plan claims to be a competent financial adviser, surely, he should also be competent enough to advise you on investing? If he is not, you might want to find another adviser. But seriously, is getting even 2% p.a. so difficult? So, I find this objection to be an excuse rather than a valid reason for not recommending term plans.

“A term plan does not mitigate inflation”

This is because a term plan does not have cash values and even after 20 years, the death benefit remains the initial sum assured that you have bought. But since the premiums for term insurance is more than ten times cheaper than whole life plans, this is easily solved by insuring yourself slightly more than you need at the onset. An invalid objection again.

But buying term insurance is not so that you can “invest the rest”. You buy term insurance simply because it is the most affordable and suitable way to adequately and immediately insure yourself. I mean, how many people are able and willing to pay premiums of $36,190 p.a.? Even if one is willing, it will eat into his surplus and he will have lesser to live a life now and save towards his future goals. But with a term plan, you can pay for coverage only till age 70 (because you do not need life coverage for most situations) and you only need to pay $2,911 p.a. So, the irony of buying whole life plans for the dual purpose of protection and savings is that you achieve neither. The premiums for whole life plans are so expensive that one would unlikely be able to afford sufficient coverage and the returns from the insurance policy is not enough to save towards your goals. You are better off separating protection from savings/investment.

The edited version of this article has been published in The Business Times on 17th October 2022.

For more related resources, check out:

1. Singapore CareShield Life 101 – Part 1

2. Unpacking ‘Buy Term and Invest the Rest’: Should That Always Be the Case?

3. Insuring Your Health: Preexisting Conditions and Insurance Solutions