You can read chapter 1 of our eBook here.

Insurance Planning Framework – Types of Losses

It is crucial to comprehend the various types of losses that may occur in the event of a life crisis. In our insurance planning framework, we specifically focus on addressing the fundamental core insurance needs to which you are exposed.

Through using these risk mitigation strategies, we put in place a guideline on what is most important for you to be protected by insurance. We have classified them into three categories that will result in financial losses during a life crisis:

1. Calamitous losses

Whole family finances are impacted, resulting in your household being unable to function.

- Breadwinner income loss due to

- Premature death

- Medical expenses

- Permanent disability or unemployment

- Other ancillary expenses due to other family members, such as serious disability

- Husband and wife income loss at the same time due to

- Premature death

- Medical expenses

- Permanent disability or unemployment

2. Serious losses

Half of the family finances are impacted, resulting in your household being barely functional.

- Income losses from spouse

- Death

- Permanent disability

- Medical expenses

- Medical expenses from other family members

3. Bearable losses

A small amount of money is impacted, derailing you from your usual cash flow.

- Medical expenses from family members from common illnesses

- Medical expenses from minor accidents or common illnesses

Out of these three categories, calamitous and serious losses would cause you a greater financial impact compared to bearable losses. Hence, we will focus on the method of risk treatment for cases that will cause calamitous and serious losses to you and your family members. We refrain from emphasising the bearable losses category because you should be able to self-insure or might already have adequate coverage through your employer’s benefits.

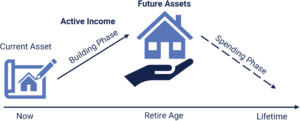

Let us look at a typical scenario in Figure 3 if a life crisis does not take place during your lifetime.

Figure 3: Typical Journey of a Crisis-Free Life

In normal circumstances of life goals, most of us start off as an accumulator upon graduation. Being an accumulator, you are dependent on your job as a source of income. By using the income earned, you start your journey in the building phase, using your savings and investments to grow your wealth toward your life goals such as retirement and your children’s education. Eventually, when you retire, you will then start your journey in the spending phase.

In the spending phase, it is more about how you allocate the spending of your wealth resources that you had built up over the decades for your daily expenses, hobbies, entertainment, and variable expenses needs. This is in a scenario where your journey in life is smooth and without any life crises occurring along the way.

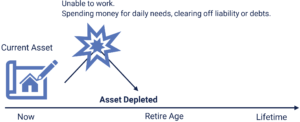

If a life crisis were to happen during your building phase, you would suffer financial impact and loss. Let us refer to Figure 4.

Figure 4: If a Life Crisis Happens During Your Building Phase

As an accumulator, it is crucial to avoid the scenario where the wealth you have diligently built over the years is insufficient to sustain you through a lifetime and is jeopardised by a life crisis. You need to be mindful of what types of life crises can prevent you from achieving your life goals.

- Premature death

- Family income loss – household expenses would need to be reduced

- Unable to afford the mortgage for your residential property

- Not enough for your children’s education fund

- Dread diseases

- Unable to work due to health – a temporary loss of income (voluntary or involuntary)

- Medical expenses

- Unable to save for your life goals

- Disabilities

- Unable to perform on your own or in any occupation (involuntary)

- Caregiving and medical expenses will be incurred

- Unable to save for your life goals

If we refer to Figure 4, once your current assets have been depleted, you will be in financial trouble. Under such circumstances, your young family members or children may have to join the workforce prematurely to earn an income and to supplement the family’s household expenses. In the worst-case scenario, your children may have to fund your retirement or medical costs. Eventually, this would limit your children’s education options as they may not have the luxury to pursue their studies.

No one desires to face a life crisis; nevertheless, in the event of its occurrence, the importance of having engaged in advanced insurance planning becomes apparent.

The building phase is a crucial part of our working lives, and we should, as much as possible, protect this journey. However, we should also not forget another significant phase – the spending phase. If a particular life crisis is not mitigated properly, it may cause a financial drain on your retirement fund. Let us refer to Figure 5.

Figure 5: If a Life Crisis Happens During Your Spending Phase

If a life crisis occurs after your retirement, the long-term medical costs become a more significant concern. If the ongoing cost is substantial, the payment must be paid through your own assets, resulting in less money to spend on your daily needs and hobbies. Hence, it is important to cover this area of risk for a lifetime to mitigate the loss of your assets and retirement fund.

You can read part two of this article here.

At Havend, if we are found to have oversold you, we have put in place a Money Back Guarantee (MBG) scheme, so you can trust that we will always prioritise your interests first. Unprecedented in Singapore, learn more about our Money Back Guarantee scheme here.

Free Download of our Insurewell for smart accumulators ebook:

By clicking on the button, you agree to allow Havend to process your information and to send you emails. Havend is committed to protecting your privacy. Your email will never be disclosed to anyone. There is an unsubscribe link at the bottom of every email. You can unsubscribe anytime by clicking on the link.